PayPal to extend 'bump' paying to Android, BlackBerry

Android and BlackBerry users envious of the new "bump" feature in PayPal's iPhone app should sit tight. Versions for their platforms are coming soon.

LAS VEGAS--Android and BlackBerry users envious of the new "bump" feature in PayPal's iPhone app should sit tight. Versions for their platforms are coming soon.

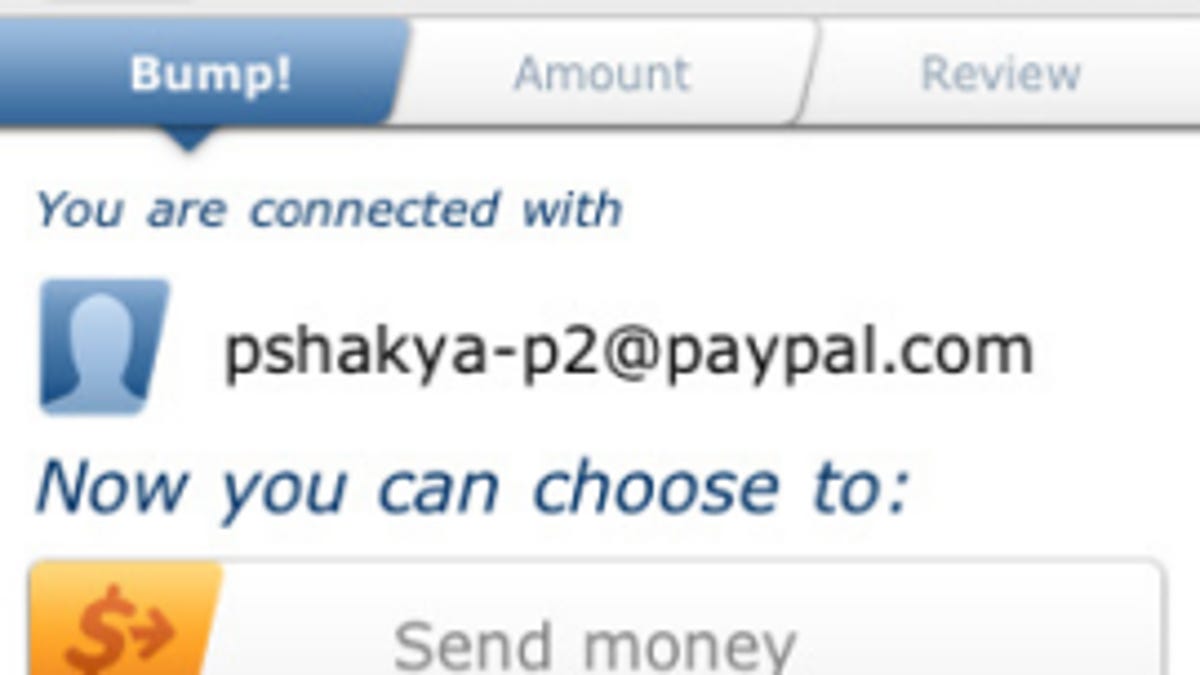

PayPal's slick new feature lets virtual money change virtual hands when two iPhones are tapped together (gently, now). The integration of Bump, which has heretofore let users exchange social information on Android phones and the iPhone, now connects PayPal users in close proximity so they can resolve debts on the spot.

"Bumping" money transfers is a practical and convenient way to settle a bill, but right now the service is limited to iPhone users. For PayPal 2.0 to really become indispensable, users need to tap out transfers from any device. During our chat with PayPal at CTIA 2010 here in Las Vegas, we learned that updates to the Android and BlackBerry app are planned for the next two or three months.

PayPal's mobile manager, Eric Duprat, cited a few other foreseeable implementations of PayPal, including paying bills from Internet-connected TV and gaming devices. "PayPal is a cloud-based wallet," Duprat said, which makes bumping and transferring just one way to access your PayPal account.

We're betting the physical and social immediacy of bumping from multiple smartphones will straighten out PayPal's user demographic, which, according to PayPal's Duprat, currently skews toward affluent males.