Optimistic outlook for venture financing

There is plenty of money on the sidelines for entrepreneurs with good ideas, according to a new venture capital report.

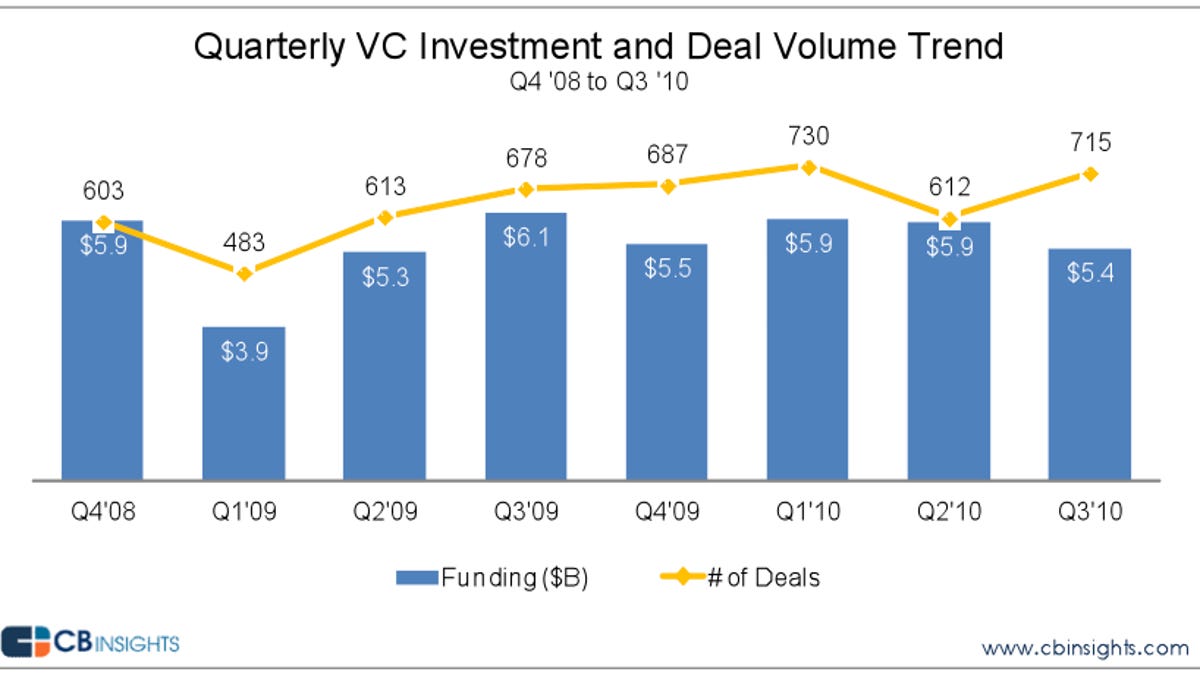

Slated to be released this week, CB Insights Q3 2010 venture capital report shows that more venture-backed deals are happening, but at lower dollar volumes, with seed deals replacing the megadeals we saw in the first half of the year.

According to the report, seed deals (typically less than $1 million) represented just 1 percent of finance deals in the third quarter of 2009, but grew to 11 percent of deals in the third quarter of 2010. In light of the growth of seed finance deals, the median deal size for Series A deals grew to $3.4 million--a five-quarter high--as more seed deals came onto the market.

There are a number of possible explanations for the growth in size of the Series A, but it likely ties back to the fact that Series A deals tend to be more mature than seed, and have a better idea of how to use capital to grow efficiently.

In terms of growth by sector, health care, along with social and advertising, saw gains in both number of dollars and volume of deals. Gaming "fell off a cliff" in Q3, according to the report, suggesting that investors have tired of the "me-too" approach or believe the market to be saturated.

July 2010 had the most active deal flow month in the last 15 months, atypical of the venture financing cycle but perhaps not too surprising considering seed rounds (often non-VC) were so prevalent. Deals themselves were all over the map, with a surprisingly large percentage (more than one-third) of deals not fitting into standard venture categorization.

Also not surprising is the fact that 70 percent of Internet deals and funding went to three states: California (44 percent), New York, (15 percent) and Massachusetts (11 percent). Additionally, California remains the most active investment state with 271 deals totaling $2.607 billion though that total represents a 15 percent drop from Q2 2010.

The top five deal-making cities:

- San Francisco -- 36 deals/$131 million

- New York -- 31 deals/$126 million

- Mountain View, Calif. -- 5 deals/$68 million

- Palo Alto, Calif. -- 10 deals/$68 million

- Reston, VA- 2 deals/$51 million

These venture financing statistics correlate to the economy as a whole as more consumers are avoiding big-ticket items in favor of bite-sized purchases. Eventually, the cycle will come back around, but for now, angel investors and virtual goods companies can ride the wave of frugality and instant gratification.