Online options raise stakes in CBS, Time Warner standoff

With a blackout of CBS' channels, the TV broadcaster and the cable giant are locked in a showdown consumers have seen before. But this time online options like Aereo are shifting the leverage in the fight.

It's a plotline so played out that if it were pitched as a script no network executive would bite.

A TV broadcaster wants more money. A cable distributor doesn't want to pay. They trade public jabs while trying to reach an agreement, and then TV channels go black when the parties don't find common ground.

That's how the story unfolded once again on Friday night between broadcaster CBS -- the parent company of CNET -- and distributor Time Warner Cable. However, this time around, technology has changed the script. Online options like over-the-air streamer Aereo and Amazon's Prime Instant Video are giving consumers more options in the blackout, which both CBS and Time Warner are both trying turn into weapons to advance their cause.

On the whole, technology is shifting the balance of power to more evenly match the broadcaster and the distributor. "Aereo and other technologies, including Dish's ad Hopper, are bargaining chips to curb programming cost inflation," said Tony Wible, an analyst at Janney Capital Markets.

That sets up a higher-stakes showdown, and right now, Aereo is the only clear winner.

Broadcast networks -- the most watched channels on television -- are free over the air, but pay-TV providers must hand over fees to the networks to retransmit them. Eager for more revenue, broadcasters push the fees higher, using their popular programming as a bargaining chip. These fees and other rising programming costs have driven cable bills higher, as cable companies pass along the costs to customers by raising rates.

But cable rates have reached such a level that if pay-TV providers continue to raise them, they face subscriber defections. If they just say no to network TV and cut out the most popular channels in their lineup, they really face subscriber defections.

Pay-TV providers' remaining option is to negotiate lower rates, and to do that they need leverage. This is where online video options are changing the game.

Tech and a balance of power

Services like Aereo, which uses a special antenna to bring over-the-air broadcast signals to the Web, make it easier than ever for some Time Warner Cable customers to simply watch CBS live on the Internet. And Amazon, in a unique licensing deal with CBS, streams the network's "Under the Dome" just four days after episodes air, making the most popular show on television readily available online. For all its other programming, CBS typically streams full-length episodes on its website for a few days after they air.

Both sides are trying to use these alternative viewing options to their advantage.

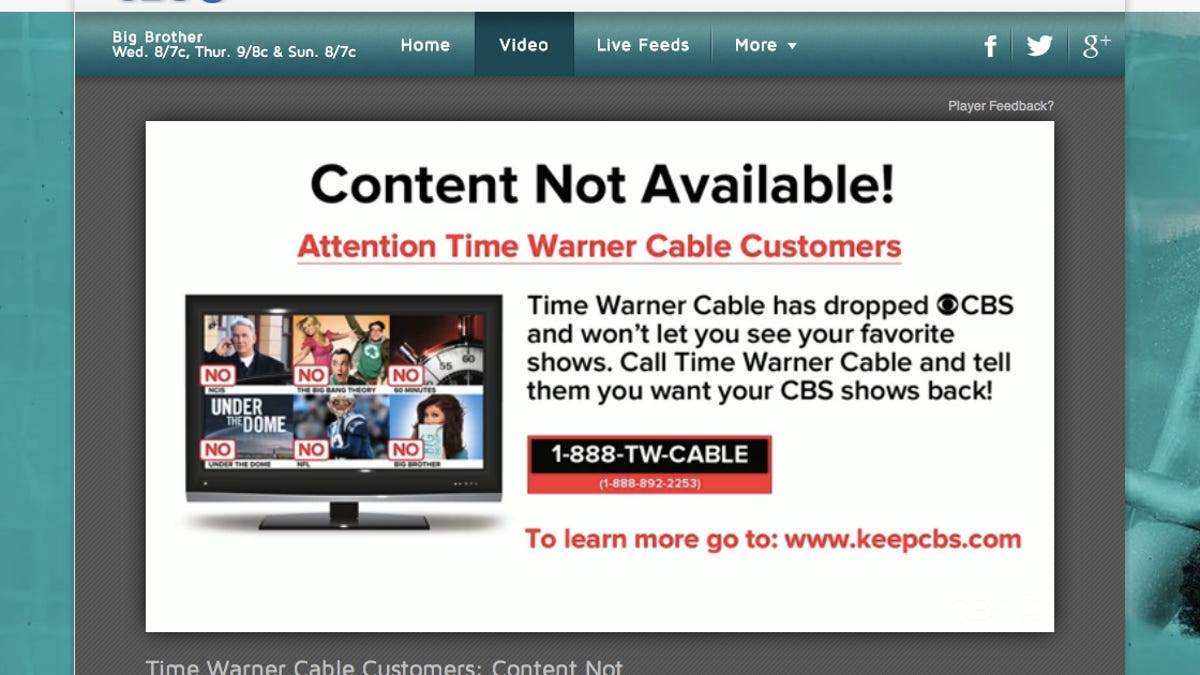

CBS, capable of knowing when a visitor to its CBS.com Web site is using Time Warner to connect to the Internet, has flipped off the switch for streaming full episodes on its site to TWC broadband customers -- even if that customer taps Time Warner only for broadband and doesn't subscribe to its video service.

The tactic is not without precedent. Fights over programming costs have intensified in recent years, leading to more blackouts. In 2010, for example, a standoff between Fox and Cablevision cut out Fox programming for more than 3 million of that cable company's video subscribers.

In that case, Fox took steps to prevent Cablevision broadband subscribers from viewing its content on Hulu, the video-streaming Web site partly owned by Fox's parent company. The broadcaster restored its programs to Hulu well before the two-week blackout came to an end.

On the other hand, Time Warner Cable is directly telling subscribers to turn to Aereo to fill the CBS vacuum on its service.

Aereo, which is backed by IAC Chairman Barry Diller, uses antenna/DVR technology to let consumers watch live, local, over-the-air television broadcasts on some Internet-connected devices for $8 a month. CBS and other broadcast giants, such as NBC, ABC, and Fox, are suing the service because of that capability, which they allege violates their copyrights and circumvents the retransmission fees that Time Warner itself is fighting. Aereo said its practice is legit, since each user has a personal dedicated antenna.

So far, CBS' arguments against Aereo have failed to win the support of courts based in New York, with the U.S. Court of Appeals for the Second Circuit denying the network's request to halt Aereo's business while the case goes to court, and, most recently, refusing to reconsider that decision again.

During the CBS negotiations,Time Warner Cable used Aereo as a leveraging tool. The cable company prepped customers for the possible blackout by touting Aereo as a possible alternative for watching CBS programming. Now that the blackout has become reality, it's directly telling its New York subscribers to check out Aereo when they encounter a blue screen where CBS programming would normally be. That's a shot over the bow of CBS, demonstrating that a service the network has adamantly fought -- to little avail -- will only gain more traction with consumers the longer CBS digs in its heels.

John Bergmayer, senior staff attorney at consumer advocacy group Public Knowledge, said that anything that varies the alternatives customers can turn to during a blackout changes the playing field.

"As for Aereo, certainly when other avenues exist to access programming, this changes the negotiating dynamic," he said. "But Aereo is just a remote antenna service, and it's worth pointing out that anyone can get an old-fashioned antenna, too."

But one key difference between using an antenna and a site like Aereo is level of convenience.

Rich Greenfield, an analyst with BTIG, noted the significance of how easy it is for a Time Warner Cable subscriber to get up from a couch and set up an Aereo stream of CBS at a computer -- in the time span of a typical commercial break. "That's a huge game-changer," he said. "Before it was: go out to your local store and get an antenna. Now it's point, click, and within minutes get the signal from Aereo."

The other key difference is that Aereo's product, unlike traditional antennas, reiterates in a 21st century way that broadcasters are fighting for higher payments for something that is, in principle, totally free. Congress created the retransmission consent system in 1992 when broadcasters were under threat of a growing cable industry. It was designed as a measure to protect local broadcast programming as cable television gained power.

But the system has evolved into a revenue engine for broadcasters, whose networks have remained so popular nobody in a now-competitive pay-TV market can rationally entertain dropping them. CBS last quarter saw its retransmission consent fees jump 57 percent from a year earlier, while its broadcast network ad revenues rose only 11 percent. The broadcasters' pursuit of higher fees and the distributors' inability to push cable rates much higher means that a system intended to keep local broadcasts available is increasingly doing the opposite: It's resulting in blackouts, like the one between CBS and Time Warner.

Broadcasters, with their popular content and a system that required cable companies to pay them for it, once held the upper hand. Now by pushing people to sites like Aereo, even at the risk of fostering a cord-cutting mentality, Time Warner Cable has demonstrated pay-TV providers can increase their leverage by promoting technology the broadcasters fear.

Aereo has largely been quiet about its position regarding the fight between CBS and Time Warner Cable. The company declined to comment on the blackout, but CEO Chet Kanojia said last month that the latest fee battle "further highlights the importance of having alternatives in the marketplace."

"It's also a great reminder that consumers have the right to watch over-the-air television using an antenna," Kanojia said. "Whether they use Aereo or some other type of antenna, it's their choice."

Now, with Time Warner Cable putting Aereo's services front and center for a broad swath of frustrated cable customers, Aereo may enjoy a windfall of people choosing its antenna to access their favorite broadcast TV shows.

Tech isn't likely to change the ending of the CBS/Time Warner saga. Like all such disputes that have come before it, the two sides will inevitably reach a deal to restore service. But technology like Aereo, the online provider of live over-the-air broadcast video, is changing the balance of power as the battle is fought.Disclosure: CBS, the parent of CNET, and other broadcasters have filed lawsuits against Aereo and against Dish over its AutoHop ad-skipping feature.