More less-than-awesome revenue gossip for Groupon

One site has crunched numbers and estimates that Groupon declines coupled with LivingSocial growth means the two sites are now about the same size in the 20 biggest U.S. metro regions.

It turned down a $6 billion acquisition offer. It wants a $25 billion initial public offering. It more or less created a breed of advertising that now every company wants into. It's grown faster than just about any company, ever. But according to multiple signals across the Web, things may be afoul at Groupon.

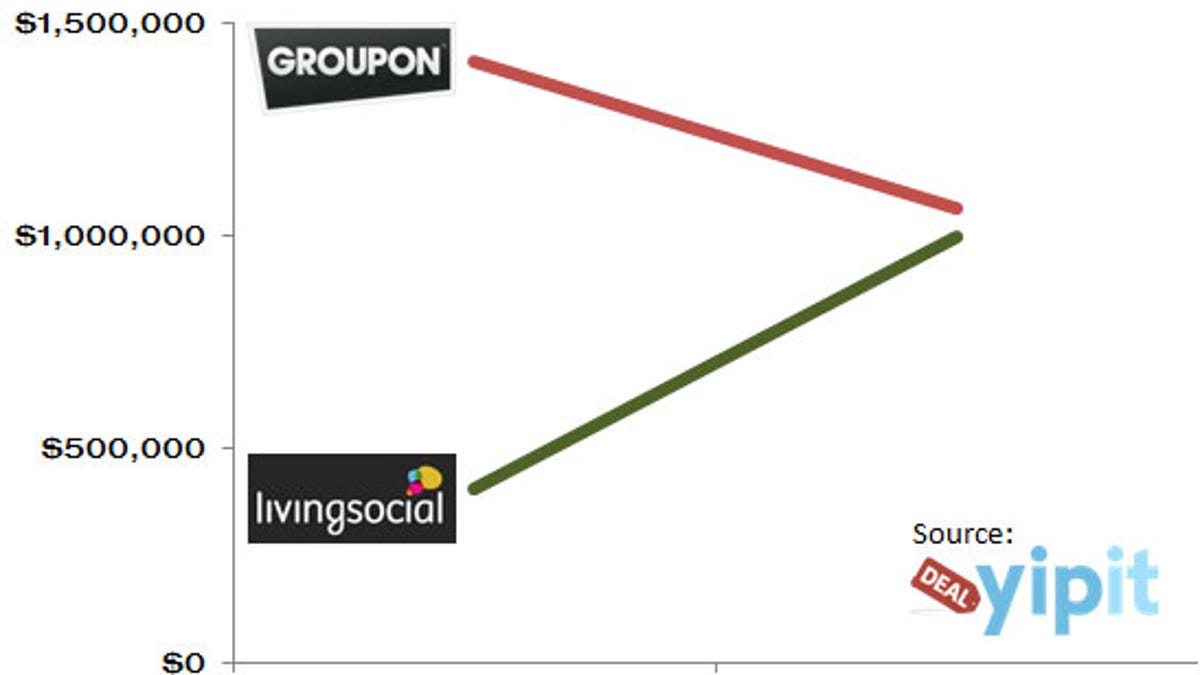

The latest is a chart released by Yipit, a start-up that aggregates cities' daily-deal offerings--more than 400 sites' worth--into a customizable digest that highlights individual users' preferences. Yipit said in a blog post today that it found a 32 percent decline in Groupon revenue per day in the top 20 U.S. markets, and that its smaller competitor LivingSocial has nearly caught up to it in those metro regions. Granted, both companies operate in way more markets, but if true, this is not a great sign for Groupon.

It also isn't the first red flag that something might be afoot. Earlier this week, it was revealed that president and chief operating officer Rob Solomon was stepping down--not the sort of thing that one would expect from an early executive at a company that's apparently headed for a monstrous IPO. Shortly thereafter, an anonymous third-party researcher with deep access to Groupon data shared some disconcerting numbers with TechCrunch: U.S. revenues, the source said, fell from $89 million to $62 million. It might have been negative reactions to Groupon's bizarro-world Super Bowl ads, reporter Erick Schonfeld surmised, or it might have been a natural drop-off after the hectic holiday season. Or it might be a sign of something worse.

One thing that we do know is that LivingSocial has been making one effective move after another, and is no longer a laughably long-shot second place to Groupon. A deal for Amazon gift cards (the e-commerce giant is a major investor in LivingSocial) caused a big spike in membership sign-ups, and according to some estimates, the Amazon deal was what catalyzed LivingSocial's jump from one-tenth the size of Groupon to one-half in the U.S. More recently, LivingSocial used a day's deals to offer to match donations to Japanese earthquake relief--another source of traffic and significant positive buzz.

UPDATE (11:29 a.m. PT): TechCrunch has backtracked on the February revenue estimates posted earlier this week, saying that (bear with me here) a new set of Groupon U.S. revenue numbers have emerged from another source and that Groupon insiders are privately saying that these--which put February revenues at a far sunnier $103 million--are the real ones.

A source in the daily deals industry also flagged CNET to suspicions of where Yipit's interests might lie in posting a chart that runs figures unfavorable to Groupon: Yipit has affiliate deals in place with some, but not all of the daily deals sites that it aggregates, meaning that it gets a cut of the earnings from a deal sold through Yipit. According to this source, Yipit does not have a relationship with Groupon any longer. Which, technically, means that Groupon and Yipit could view one another as competitors and that it would be in Yipit's best interest to promote non-Groupon deals sites with which it does have affiliate deals.

UPDATE (12:17 p.m. PT): Yipit co-founder Vinicius Vacanti told CNET via e-mail: "We do not have a business relationship with LivingSocial and we do not have a business relationship with Groupon."