Microsoft deal allows B&N to go toe-to-toe with Amazon and Apple

Microsoft's $300 million investment not only offers a big cash infusion to beleaguered Barnes & Noble but also sends a message to consumers that it's here to stay.

In the last couple of years Barnes & Noble has made some big inroads into the e-book market, cutting into Amazon's huge lead. As it stands, Amazon still has about 60 percent of the e-book pie, Barnes & Noble has around 25 percent, and Apple sits at around 15 percent, with smaller players like Sony, Google, and Kobo left to fight over the crumbs. Of course, those numbers are just estimates, and depending on who you talk to, Amazon's share might actually be closer to 65 percent.

While a strong second place is not a bad position to be in, the problem for Barnes & Noble has been how much it cost to get there and how much it's going to cost to pick up more market share from Amazon and Apple, which has steadily ramped up its iBooks digital reading platform and recently launched a major digital textbook initiative. Both Amazon and Apple, needless to say, have huge cash reserves to dip into for marketing, engineering, and R&D, while Barnes & Noble has appeared at times as if it's simply battling for survival.

Enter Microsoft and its $300 million investment in what amounts to a spinoff of Barnes & Noble's Nook digital media business, which includes e-books, textbooks, and all those digital newspapers and magazines its been selling on Nook devices. So far the new "subsidiary" of Barnes & Noble doesn't have a name (it's simply referred to as Newco) but you might as well call it Nooksoft (read more about the announcement here).

Obviously, the cash injection is important because Barnes & Noble has been hemorrhaging money as it beefs up its Silicon Valley-based digital operation with expensive software engineers and hardware designers (a New York Times article noted that Barnes & Noble already has 300 employees in its Palo Alto, Calif., office). The new company also frees up additional cash for Barnes & Noble to compete with Amazon and Apple's huge marketing machines and attract more talented engineers with potentially lucrative stock options. The other obvious benefit to the deal is it allows the bookseller to bring the Nook e-bookstore to Windows 8 devices, whether they be PCs, tablets, or smartphones, though Amazon's Kindle app will be available for the Windows 8 platform as well.

Today's announcement also marks the first time that Barnes & Noble has openly talked about going global, though it remains unclear when it will bring its Nook devices to overseas markets. In a conference call, CEO William Lynch said that few companies were "on more screens than Microsoft" and that the new partnership would allow Barnes & Noble to to extend the Nook digital bookstore to thousands of users in the U.S. and globally. Amazon is also making a big push into global markets and Apple, of course, is already selling millions of iPhones and iPads around the world.

Here in the U.S., in the wake of the government's lawsuit against Apple and five of the "big six" publishers (and subsequent settlement with three of them), there's talk of Amazon once again lower prices on e-books and selling certain titles at a loss. In the past, competitors had trouble matching Amazon's prices, but Microsoft's cash infusion would make it easier for Barnes & Noble to go toe-to-toe on pricing.

Ultimately, however, the biggest benefit of the deal may be a change in consumers' psyche about Barnes & Noble. In the commodity world of e-books, branding is important, and many consumers fear that their purchases, which are stored in a "digital locker," will vanish if a company goes out of business. When Borders went belly up, consumers were simply migrated over to Kobo because Kobo already powered Borders e-book store. But no one knows exactly what would happen if Barnes & Noble went down the tubes, and not a Nook story goes by on CNET without a commenter voicing some concern over Barnes & Noble's longevity.

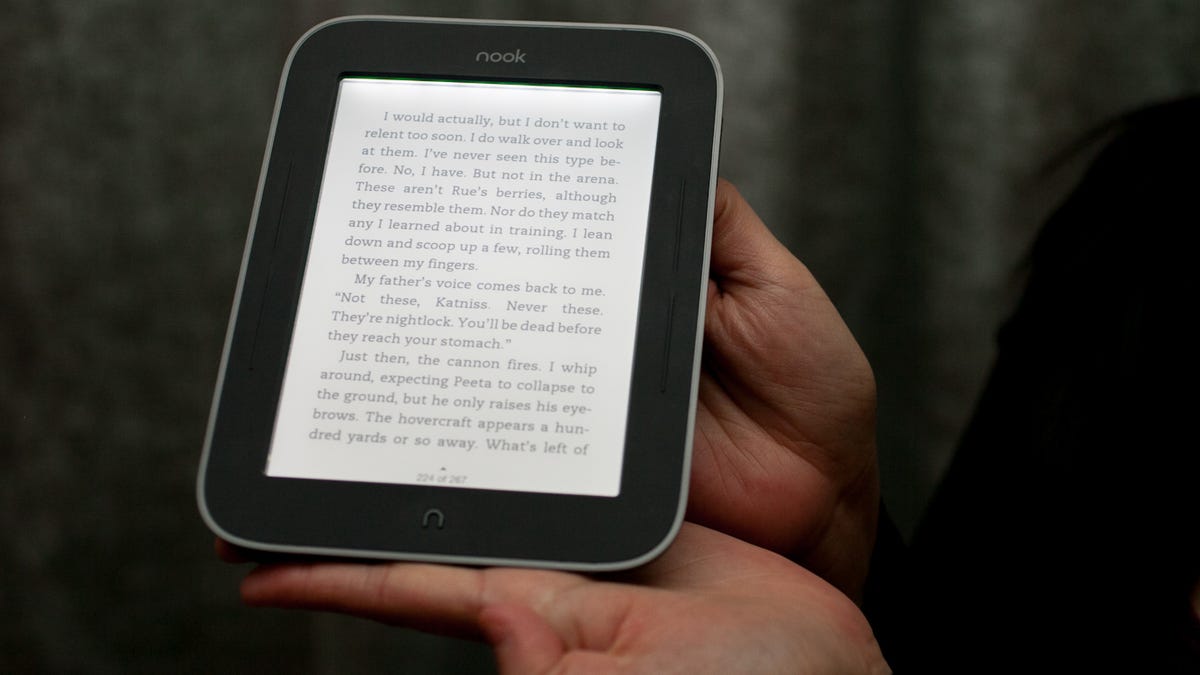

"I've always thought that the Nooks were a bit better designed than the Kindles," said CNET reader tgibbs in a recent comment concerning the arrival of the Nook Simple Touch with GlowLight. "But I bought a Kindle because I'm more confident that Amazon will still be around in the future."

With a giant like Microsoft backstopping the Nook, consumers may now have more confidence that the Nook platform will indeed be here to stay. And that type of peace of mind is just as essential in helping Barnes & Noble gain market share than money alone.