How T-Mobile is priming a stronger LTE network with MetroPCS

T-Mobile needs MetroPCS to refine its new LTE charge. Here's why the two are better together.

T-Mobile's salty, spirited launch of its better-late-than-never LTE network and new contract-free ethos may have felt like a sudden surge come from nowhere, but in fact, it was a well-calculated and slowly calibrated, years-long effort to save an ailing network.

Truth is, the fiery, passionate T-Mobile we saw during its "Uncarrier" event this week wouldn't have been possible without some failures and careful planning. T-Mobile's prognosis is also buoyed by an imminent clinch success: the federally approved purchase of prepaid carrier MetroPCS (the still hasn't been fully approved.)

Out of the spectrum crisis

T-Mobile is the last major U.S. carrier to introduce LTE, due to a spectrum crunch that left it nowhere to build out LTE without cannibalizing its 3G-based network. Ironically, its failed merger with AT&T was the catalyst for T-Mobile's faster 4G.

AT&T handed over $3 billion to T-Mobile parent Deutsche Telekom as part of the breakup deal, and the same again in assets, giving T-Mobile some desperately needed cash and seed spectrum to make real strides over what it already owned.

Beyond gaining AWS spectrum from AT&T as a condition of the merger implosion, Verizon and T-Mobile shook hands on a spectrum swap that gave T-Mobile enough spectrum for 60 million people in major cities.

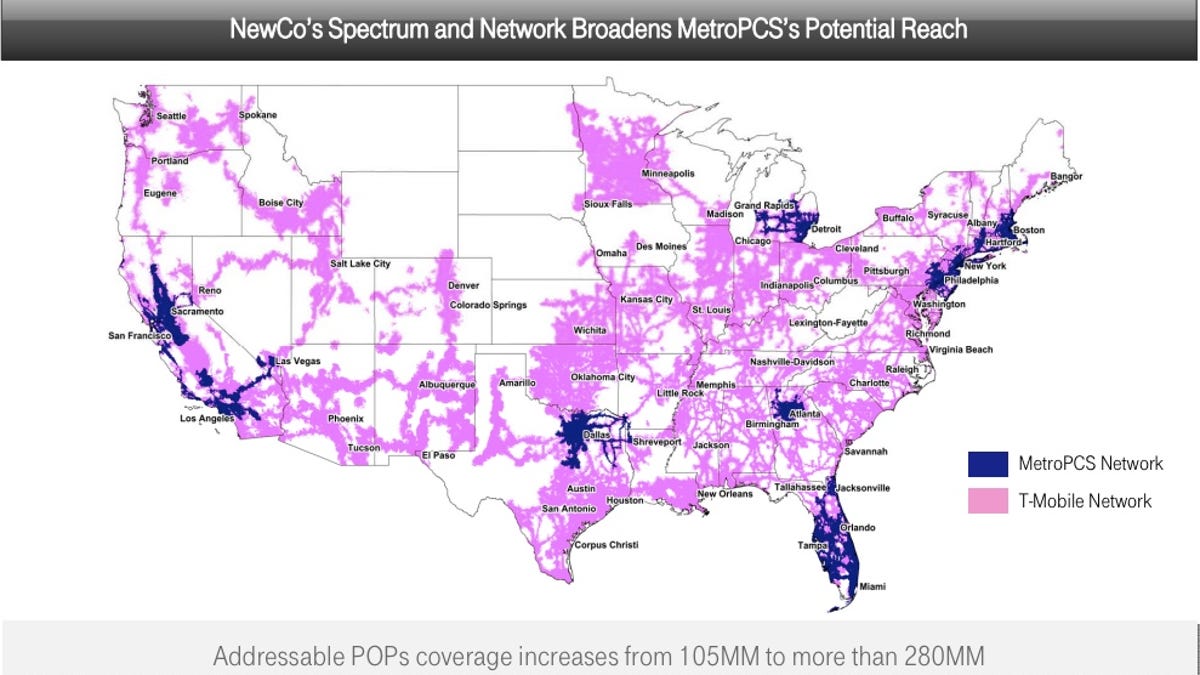

MetroPCS' assets are another key stepping stone that T-Mobile needs to grow. MetroPCS has 13MHz of spectrum in top 25 urban centers, which T-Mobile will use to cover existing and future subscribers.

In addition to T-Mobile getting greater coverage capacity to play with in Metro's metro markets, the company can begin migrating its 3G-based HSPA+ (4G) network onto Metro's PCS spectrum, and also convert Metro's AWS spectrum into more LTE.

The upshot is that T-Mobile has stitched together a greater range of assets that span high- and low-spectrum bands to bring broader, deeper coverage that can stretch across states and penetrate walls. MetroPCS' network will form a major part of T-Mobile's plans once the merger begins in earnest.

Updated network

In the meantime, T-Mobile hasn't been idle. To get to this point, it's invested $4 billion into modernizing its network equipment.

That means upgrading 37,000 physical cell sites with new antennas and electronics, including multimodal radios that can switch among spectrum bands, including PCS and AWS types.

Once the MetroPCS merger is complete, T-Mobile will be able to put those towers to use to bulk up its performance in the urban areas where MetroPCS currently operates.

It also plans to decommission MetroPCS' CDMA network and rely on its own.

Scoop up subscribers

Another major benefit of the merger is adopting -- and keeping -- MetroPCS' roughly 9.3 million customers. Even combined with T-Mobile's current 33.4 million subscribers, the merged companies can't hope to overtake Verizon or AT&T -- which serve 98 million people and 107 people, respectively -- but if you're a company desperate to stay in the game, every bit helps.

T-Mobile plans to fold in MetroPCS customers as soon as the takeover deal is signed and dotted, expecting everyone to transition by the second half of 2015. T-Mobile plans to move customers organically, as they upgrade devices.

"MetroPCS will cover 225 million pops when we merge," T-Mobile CEO John Legere said during the event, adding that the savings from closing the MetroPCS network and moving people over to T-Mobile are astronomical.

How fast can it go?

The question of speed is a hot topic, and a crucial one for T-Mobile's long-term success. Sprint is suffering from its constrained LTE performance, a fate that T-Mobile must avoid at all costs.

CNET's Brian Bennett got a chance to put T-Mobile's 4G LTE claims to the test on a demo network set up in New York City specifically for press.

Brian saw impressive speeds on the iPhone 5, BlackBerry Z10, and HTC One, including download speeds between 20 to 30Mbps and upload speeds of 15 to 20Mbps.

Of course, there were very few phones demanding juice from the ad-hoc network, which could signal slower speeds in real-world situations. On the other hand, maybe not. Localized network strength also plays a tremendous role in future performance, with some cities and towns getting faster, wider coverage than others based on the configuration of cell towers in the area.

For its part, T-Mobile has promised a 10MHz by 10MHz LTE network, and claims that with MetroPCS' combined assets, it'll be able to grow up to a 20MHz by 20MHz network.

Will it all pan out?

Despite the forward momentum, T-Mobile still faces technical, practical, and business challenges of navigating a merger and multiple technical migrations at the same time.The LTE network is nascent and must expand quickly, while also holding up under the pressure of actual users. That's a potentially tall order for a company offering unlimited 4G plans.

On top of that, T-Mobile will have to keep current customers while transitioning to a new business model, and attempt to build its base with converting new customers from rivals.

It will have to spend heavily on marketing if it hopes to turn the tide away from traditional two-year contract plans to its new no-contract model, and it must continue to supply top-notch phones and friendly customer support.

Though the situation looks promising, the payoff from T-Mobile's risky gamble is still a long way off.

Article updated at 10:16am PT to correct network range from GHz to MHz.