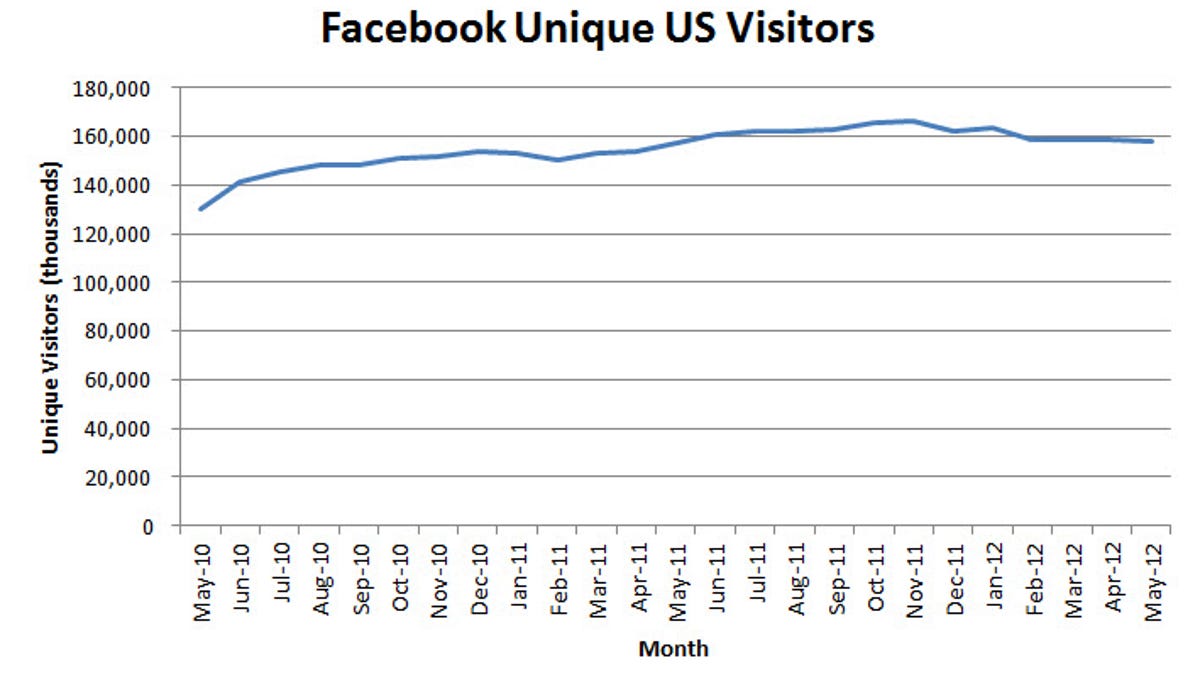

Facebook is continuing to shed U.S. visitors

A ComScore report found that Facebook unique users were down slightly from April to May, but the bigger picture is worse -- a 4.8 percent in 6 months.

Analysts and investors have been concerned about Facebook's future performance since the company's IPO, with slowing growth a major issue. Another worry was Facebook's revelation that it does not make money from mobile users -- especially because mobile looks like the growth area. Furthermore, according to SEC filings, half of Facebook's revenue in the first quarter of 2012 was from the U.S. and Canada, down from 52 percent in all of 2011, so audience size in North America is critical to the company's ongoing success.

According to ComScore's numbers, which aren't adjusted for a change in the firm's methodology, there has been a general downward trend in the number of U.S. unique visitors since November 2011. If Facebook were still growing, the methodology change should have shown a single drop, representing the correction, and then a continuing upward trend. Facebook did not respond to a request for comment.

Nielsen data also suggest a drop. According to Nielsen's numbers, Facebook had 156.2 million uniques in November 2011, 152.8 million in March 2012, 151.4 million in April 2012, and 152.7 million in May 2012. That 2.2 percent drop would still be significant, although lower than ComScore's report.

It isn't the first time ComScore has shown a downward trend in Facebook uniques. Between December 2010 and February 2011 there was just under a 2.1 percent drop, so there is a possibility that Facebook has some sort of seasonality, although the current downward trend is already longer than the previous one.

A problem for Facebook

The problem for Facebook is that the company's steep market valuation -- it trades at about 80 times trailing revenues -- is based on further revenue growth. That could happen in two ways: more users or more money made per user. Over its history, the company has an impressive track record of gaining users but it hasn't done as good a job of monetizing the ones it has. Last year, it made on the average only $5.11 per user. Furthermore, its greatest user growth has been in regions where the revenue per user is lower. Facebook is working on a way to better target advertising according to Beyers and, presumably, achieve higher ad rates. "We don't know how good that is yet," he says.

In its most recent quarterly financial filings with the SEC, Facebook claimed more than 900 million monthly active users, based on its internal data. According to the company, the term active user can include people who don't go to the Web site but "took an action to share content or activity with his or her Facebook friends or connections via a third-party Web site that is integrated with Facebook." It may be that an increasing number of people are sharing content and opinions through Facebook but logging onto the site less frequently and, as a result, seeing fewer ads and generating less revenue.

Another possible explanation of the recent drop would be if a growing number of people came to use Facebook only from a mobile device and not, in addition, a desktop computer. ComScore and Nielsen can have difficulty identifying when a person visits a site through multiple devices, so if users moved from access through a desktop browser and mobile app to just the mobile app, it would look like one fewer user.

Facebook's stock price climbed 10 percent last week, yet still has not climbed back to its IPO price. If the company starts to lose users in its most productive customer segments, it will face further pressure to increase the amount it makes from those who remain.

This report originally appeared on CBSNews.com under the headline "Facebook U.S. unique users down 4.8% in 6 months."