David Einhorn tries to woo Apple shareholders with cash

The outspoken Apple investor pitches others on his plan to set up a recurring payout called iPrefs.

Apple's cash problem is easy to solve, one of its most outspoken shareholders said today.

During a conference call with Apple investors today, David Einhorn of Greenlight Capital -- which is currently in litigation with the iPhone and iPad maker -- made the case that Apple's strategy to stockpile cash was flawed, and argued that his plan to bring some of that back to investors could be solved with a new program called "iPrefs."

"Many have asked, why not just increase the dividend?" Einhorn said. "This sounds too complicated. It's not complicated. It's merely unfamiliar."

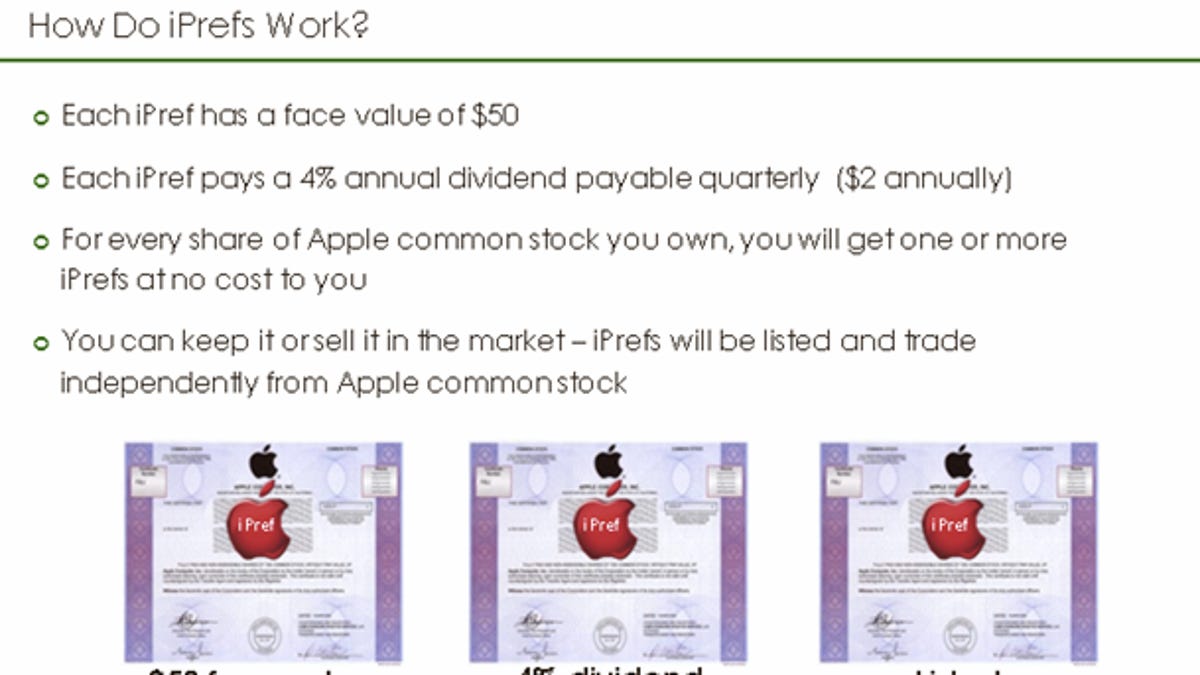

Greenlight's solution to a possible increase in Apple's own dividend program is called iPrefs -- a $50 stock with a 4 percent annual dividend. These could be traded separate from Apple's existing stock, and current investors would be given "one or more iPrefs at no cost," Einhorn said.

The program could help Apple repatriate some of its offshore cash pile, and open up the company to a new group of investors who want a low-risk investment with regular returns, Einhorn argued.

Greenlight Capital sued Apple earlier this month, attempting to block a shareholder vote at the company's annual meeting next week that could change how Apple handles preferred stock.

In an onstage interview earlier this month, Apple CEO Tim Cook referred to the suit as a "silly sideshow" and a waste of resources for both groups. In a legal filing, the company also accused Einhorn of attempting to hold company investors "hostage" with "attempts to coerce Apple into an agreement that serves plaintiff's financial interests."

Last year Apple announced its dividend program as well as a $10 billion stock buyback, answering what had become a frequent question at investor meetings and quarterly conference calls with analysts about how and when Apple would use some of its massive cash hoard. Even with that, some investors -- including Einhorn -- believe the company can do more to address the more than two-thirds of the cash that Apple keeps offshore.

During the call, Einhorn was keen to note that the plan for iPrefs could work, even if Apple intends to use some or all of its cash pile for future products and acquisitions.

"We don't know what their plans are, and we don't need to know. The beauty of our idea lets them run their business no matter what those ideas are," he said.

Not everyone was swayed by Einhorn's argument. In a statement late this afternoon, Simon Greer, CEO of the Nathan Cummings Foundation, effectively called the conference call and presentation shortsighted.

"Today investors learned nothing about how Mr. Einhorn's plan would improve governance practices and long-term value creation," Greer said. "Instead, he chose to give a lengthy and spirited defense of his particular approach to issuing preferred shares."

Greer added that the group was not opposed to the concept of the preferred shares, but said that Einhorn's plan could limit shareholder rights in the way it was being accomplished.

Apple holds its annual shareholders meeting next Wednesday at its headquarters in Cupertino, Calif., where the company is also expected to discuss its dividend program and the progress of its stock buyback plan.

Updated at 2:41 p.m. PT with statement from Nathan Cummings Foundation's CEO.