Can Sprint put the 'pedal to metal' on its comeback plans?

Now that the burden of M&A drama and the Nextel network is lifted from Sprint, the company needs to race to keep up with the competitive environment.

Get ready for Sprint unshackled.

The Overland Park, Kan., company is poised to step up its game on multiple fronts in the coming months, with plans to get more vocal on the marketing front and to improve its service by accelerating its network upgrade plans.

"Our real focus on the second half is putting the pedal to the metal on 'Network Vision,'" CEO Dan Hesse told CNET on Tuesday. "We're making sure we finish 2013 with a phenomenal network."

Just how long before the more aggressive Sprint emerges remains up in the air. The company is racing to build out its LTE market, and Hesse said on a conference call Tuesday he believes his company will build a network that is similar or superior to rivals by late this year or early 2014, and that consumers will start hearing about it then.

The new Sprint cannot emerge soon enough. The company's push for a sustained turnaround comes as the competitive environment further intensifies, forcing Sprint to move quickly or get left behind.

Sprint has been quiet over the last several months, allowing larger rivals such as AT&T and Verizon Wireless to further cement their hold over the industry and a resurgent T-Mobile to score a majority of the attention-grabbing headlines. Sprint has been distracted by the shutdown of its Nextel network, dealing with several transactions -- including an unsolicited bid -- all while trying to catch up to its rivals in the LTE race.

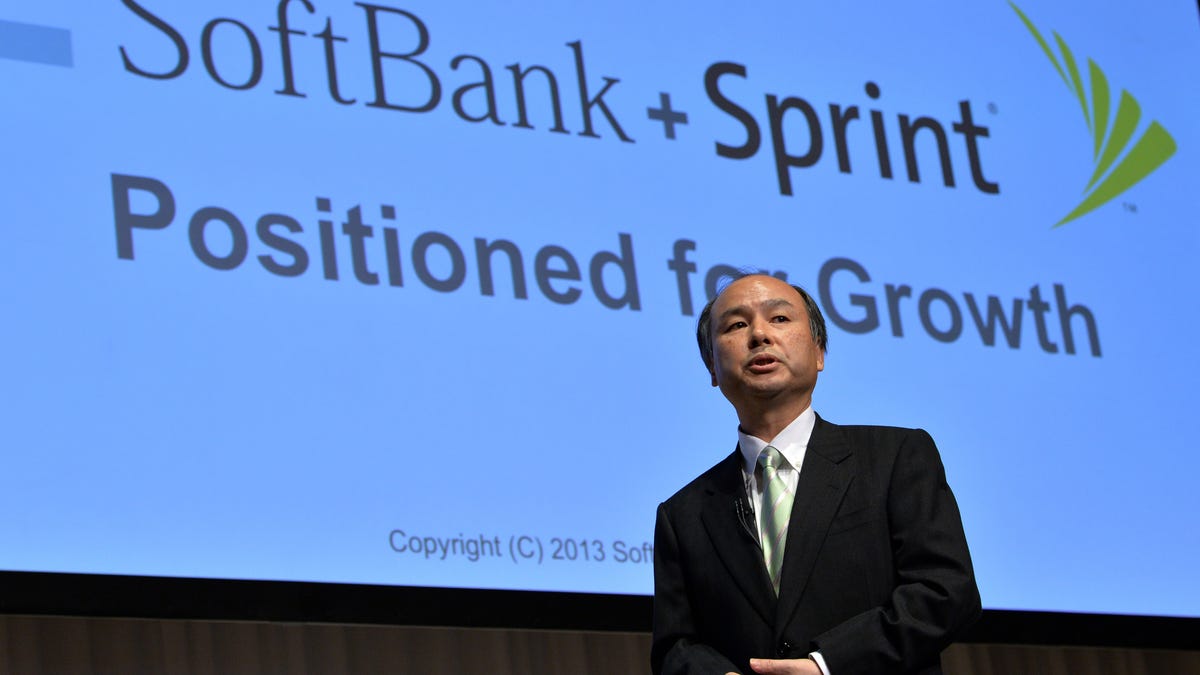

A lot of the drama, however, has cleared up. And while Sprint endured an ugly second quarter, the company has a lot of reasons to be optimistic. Sprint no longer has to deal with the separate Nextel network, which has long been a burden on its finances and focus. Sprint will also benefit from an infusion of cash and expertise from new majority owner SoftBank. Sprint's LTE network -- which has languished behind rivals -- will be getting a boost from Clearwire's spectrum capacity.

"Sprint offers more upside over the next two to three years than any other name in the sector," said Jonathan Chaplin, an analyst at New Street Research.

The most immediate improvement should come from the subscriber side. The carrier lost 2 million customers in the second quarter, Sprint reported Monday, largely from an exodus of customers leaving the now-defunct Nextel network.

Sprint expects to return to positive subscriber growth in the second half, with prepaid customer growth swinging back into the black by the third quarter, according to Chief Financial Officer Joe Euteneuer.

Those improvements, however, are expected to be modest. The company has taken criticism for the slow rollout of it faster LTE network, and Hesse acknowledged that the lack of LTE has hurt the company's growth. While Sprint is expected to return to customer growth, the core Sprint service may not see much improvement due to the competitive environment and seasonal pressures.

"As the industry grows increasingly competitive, the need for an aggressive response from Sprint grows as well," said Craig Moffett, an analyst at Moffett Research.

Hesse wouldn't elaborate on any planned responses in the second half and didn't comment on T-Mobile's recent particular focus on Sprint, but he conceded that Sprint has been in a vulnerable position.

"I can completely understand why our competitors would want to try to take advantage of our situation," Hesse said.

From a marketing and promotional perspective, Sprint has kept a low profile as well. T-Mobile recently hosted two splashy events, Verizon Wireless just launched its latest Droid line-up, and AT&T has popped up for the launch of high-profile phones such as the Nokia Lumia 1020. Meanwhile, Sprint has been mum on the device side.

In response to T-Mobile's recent launch of its Jump early upgrade, Sprint introduced a lifetime guarantee on unlimited data. Where T-Mobile announced its program at a glitzy event in Manhattan, Sprint made its announcement via a press release two days later.

Hesse noted that Sprint spent the least amount on marketing out of the big four national carriers, and that it is focused on profitable growth.

That could change toward the end of the year as the network quality improves and the company has more to brag about.

"You'll see more network messaging making (consumers) aware of our improvements," Hesse said.

Much of its marketing effort this year will be done on a local basis and applied to cities where LTE is available on a wide scale, Hesse told CNET. Even when Sprint "announces" that LTE is in a market, the rollout often isn't complete yet. Hesse said to expect a national campaign some time next year.

The progress in its network upgrade is slow, but moving. Sprint said Monday that it had extended LTE coverage to 41 new markets, bringing its total to 151. But issues in New York and the delay in other big cities underscore the difficulties it continues to face with its network improvements.

Why Sprint is taking its sweet time with 4G LTEClearwire's spectrum will play a key role in the faster network. Steve Elfman, president of networks and wholesale for Sprint, said the company is already putting the recently acquired spectrum to work. The company recently introduced a mobile hotspot able to ride on three different bands of spectrum -- Sprint's LTE band, the former Nextel band (to be repurposed for Sprint's LTE), and Clearwire's band. Elfman said that the first smartphones compatible with Clearwire's spectrum will come later this year.

He added that all devices would be compatible with Clearwire's band next year, although he backtracked a bit when asked about whether that included the iPhone and declined to comment specifically on the next version of Apple's smartphone.

Much of the turnaround hinges upon Elfman's team executing, something he's acutely aware of.

"Our job is to keep going faster and faster -- at least, that's what I hear every day," Elfman said.