California leads charge in angel rounds, study finds

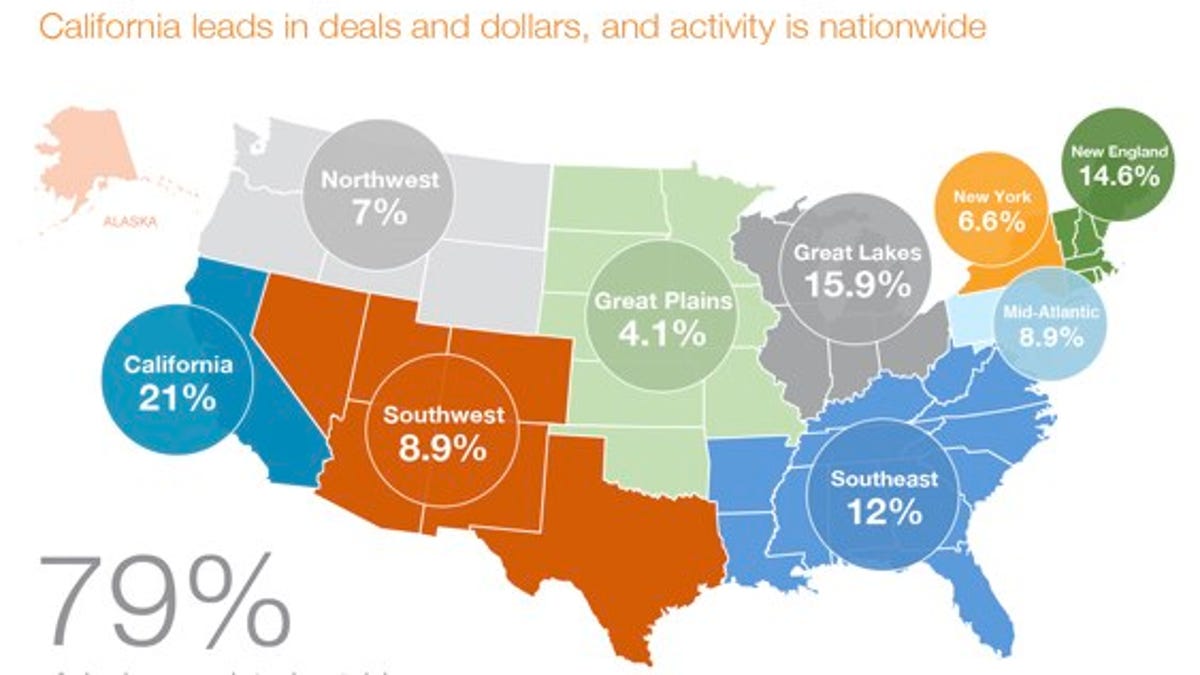

Study from Angel Resource Institute, Silicon Valley Bank, and CB Insights finds that 21 percent of angel group investments in 2011 occurred in California, and, not surprisingly, most of those were in Internet companies.

Three companies have combined forces to take a look at the state of angel round investing.

The Angel Resource Institute, Silicon Valley Bank, and CB Insights have revealed in their first Halo Report, a study on the current state of early-stage investment across the U.S., that California is, as many might expect, the top destination for entrepreneurs looking to raise cash.

According to the study, 21 percent of all investments were secured last year in California. The Great Lakes region, including Ohio and Wisconsin, among other states, accounted for 15.9 percent of all angel investing in 2011. New England, led mainly by Boston, was able to nab 14.6 percent of all investments, while the Southeast came in at 12 percent. New York offered up 6.6 percent of all the investment dollars last year.

As one might expect, California-based venture capitalists were more likely to ink investment deals in the Internet industry than any other, accounting for 37.4 percent of all the deals made in that state last year. Health care came in second place, representing 23.5 percent of the deals struck in California.

It's a similar story in Boston where Internet-related deals accounted for 28.8 percent of all the investments made last year. Health care came in second with 16.3 percent share of the investment activity. Elsewhere around the country, including in the Great Lakes region, Southeast, and Southwest, health care reigned supreme, according to the firms.

Here are some of the other findings in the Halo Report:

- The median angel round investment size was $700,000 in 2011. In 2010, that figure stood at $500,000.

- The median Internet angel round size was up just barely over 2010, reaching $1.01 million.

- Internet and health care deals combined to account for 58 percent of all angel investments last year.

- California companies handed over 29.8 percent of all the dollars invested in early-stage startups last year.

The Halo Report's data was collected via survey and "aggregation of public data." It includes information collected on 573 deals amounting to $873.3 million in total investments.