Apps in the smart home: An entry point for carriers

Carriers like AT&T lost control in the smartphone wars. But smart homes could provide a path back to control before OS vendors jump in.

These days, the smartphone sector revolves around the competition among Apple, Google, and Microsoft. Those three companies wrested power from the likes of Motorola, Nokia, and BlackBerry (then RIM) -- but there was also another group sidelined in the rise of the smartphone, even as its members profited immensely from the uprising: mobile operators.

Especially in the US, carriers still serve as a vital gateway to phone purchases; their stores are the most popular way that consumers buy smartphones. And how they stock, price, and merchandise new smartphones can make a big difference in how well those phones do.

Once upon a time, the carriers were not only the gatekeepers to hardware, they also controlled virtually everything that could be consumed on the device. Major US operators did (and still do) approve development environments for feature phones, and they controlled media stores for at least music (video wasn't really feasible in that day). We still see signs of this today with Cricket's Muve Music offering.

By and large, however, the operating system vendors have moved into the driver's seat. They took over the billing relationship, letting consumers bill apps and other media to OS vendors at their discretion. They took control of the app selection, and they came to run the media stores.

But a subset of the wide array of apps that disrupted control by the carriers may, in fact, lead back to them. For example, today we have different apps for many different video sources -- Netflix, Amazon Prime Video, broadcast networks, and so on -- with no easy way to search among them. There is a rich opportunity for pay-TV providers to step in and simplify with their own apps, as many have. Indeed, it might even be worthwhile to have those apps search competitive services such as Hulu to show just how much of their content is available through their existing pay-TV subscription.

And there's another class of apps that wireless carriers could aggregate: companion apps for communicating with and controlling all manner of "appcessories" -- products that include pedometers and fitness trackers, smartwatches, thermostats, and washing machines. Today, each of these products, or at least each brand of products, has its own app. Not only is that an organizational challenge, but it also poses the challenge of having them operate in meaningful ways. For example, if a dishwasher reports a leak, you might want to shut off the water valve, but a Maytag app probably can't do that.

There are some third-party options. The IFTTT cloud service allows different kinds of devices to access it. Belkin's WeMo power products, for example, are compatible with it. Then there's SmartThings, the Minnesota-based crowdfunding success story that's attracting a strong degree of support.

Beyond these upstarts, there's nothing preventing Apple from creating a user interface method or cloud service that requires, or at least strongly pushes, all manner of app-controllable things to move between. Examples include Apple's Newsstand for publications and Passbook for transactions.

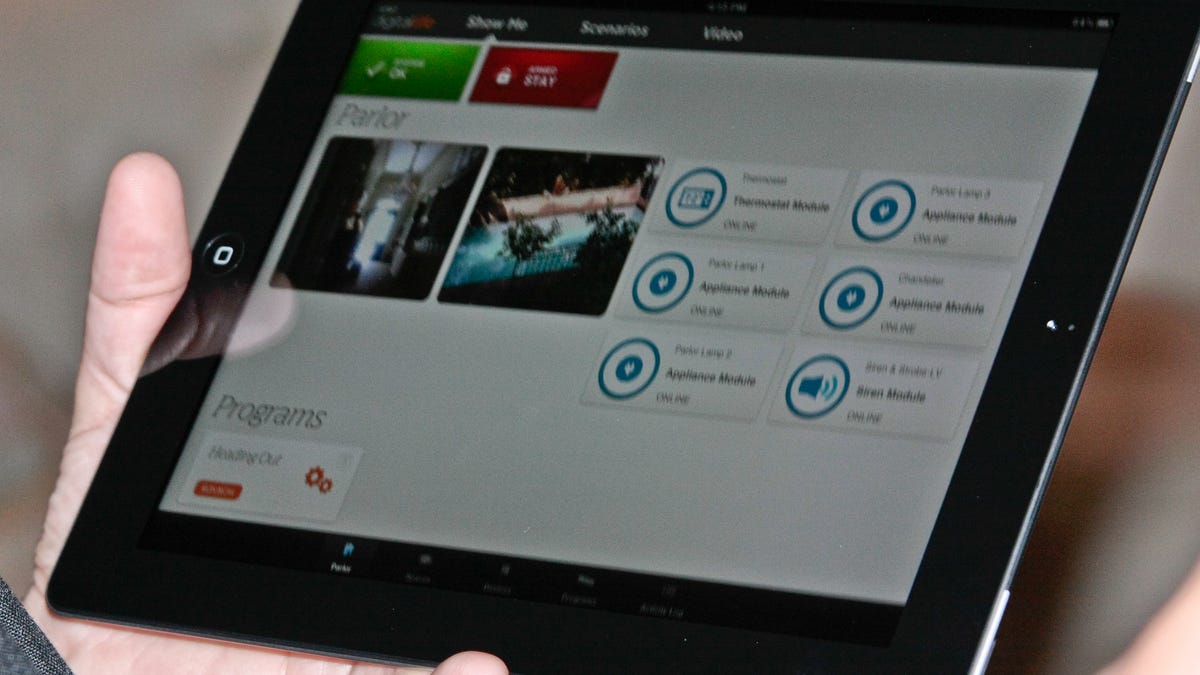

But unlike with late-to-market TV Everywhere initiatives, at least one mobile operator has moved aggressively into app-based home device management -- AT&T with its Digital Life product. The wireless service company is opening up its API to allow other products to interface with its system.

What's holding back faster adoption is that these services are predicated on consumers' owning a home security system, and most consumers don't.

If AT&T and others can evangelize their systems as a centralized device interface independent of its own services but designed to integrate into it, this may not only emerge as a strong primary interface before the OS vendors jump in, but also entice consumers to adopt their hardware and service for monitoring and controlling their homes and cars.