Apple tips chip spending scales in favor of wireless

The popularity of Apple's handheld products like the iPad and iPhone is pushing the lion's share of chip spending to wireless, away from traditional computer-related spending.

The popularity of Apple's iPad and iPhone is driving the shift of chip spending to wireless from computers, according to IHS-iSuppli.

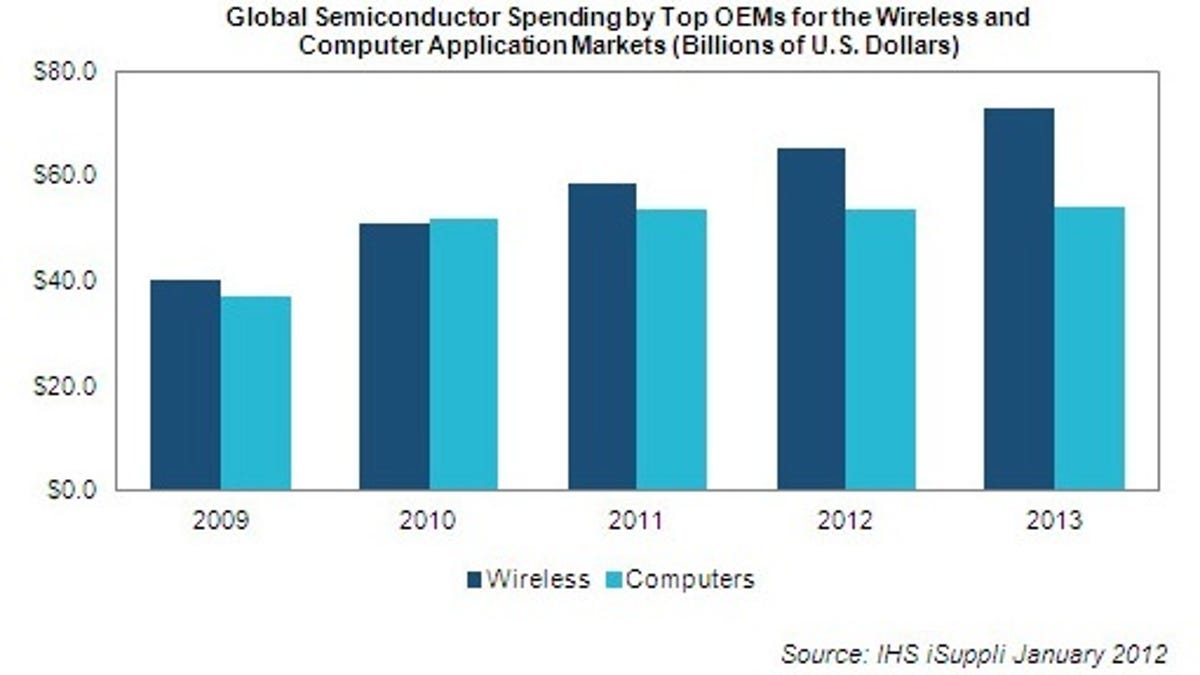

Global spending by the world's top device makers on chips for wireless products amounted to $58.6 billion in 2011, up 14.5 percent from $51.2 billion in 2010, according to IHS iSuppli. As a result, spending for computers was topped by wireless, which became the world's largest semiconductor spending segment for device makers--aka, OEMs or original equipment manufacturers--in 2011.

Though this is not the first time wireless spending has exceeded that of computer-related spending (it happened in 2009), 2011 "does mark the beginning of a period when the balance of semiconductor spending will shift decisively toward wireless and away from computing," IHS-iSuppli said.

In 2013, OEM wireless spending is projected to jump to $72.9 billion, while computers will remain flat at $53.4 billion, the market research firm said.

While mobile handsets continue to account for most of the wireless semiconductor segment sales, tablets--a relatively new device category--are a big factor behind wireless spending growth, iSuppli said.

Among tablet suppliers, Apple in 2011 spent more than any other OEM on semiconductors--a whopping $4.6 billion. Samsung was a distant second after Apple with $603.2 million, followed by HTC with $199.2 million.

Computer semiconductor spending in 2011 rose by just 4 percent to $53.7 billion, up from $51.8 billion in 2010.

"The market for desktops and notebooks has stumbled in the shadow of smartphones and tablets, whose portability and computer-like features have usurped the position of the once-mighty PCs," said Wenlie Ye, an analyst at IHS-iSuppli.

Total semiconductor spending among the industry's major OEMs for all application markets in 2011 reached $240.6 billion, up approximately 5 percent from $230.1 billion in 2010, according to IHS-iSuppli.