Apple, Samsung put hammerlock on smartphone profits

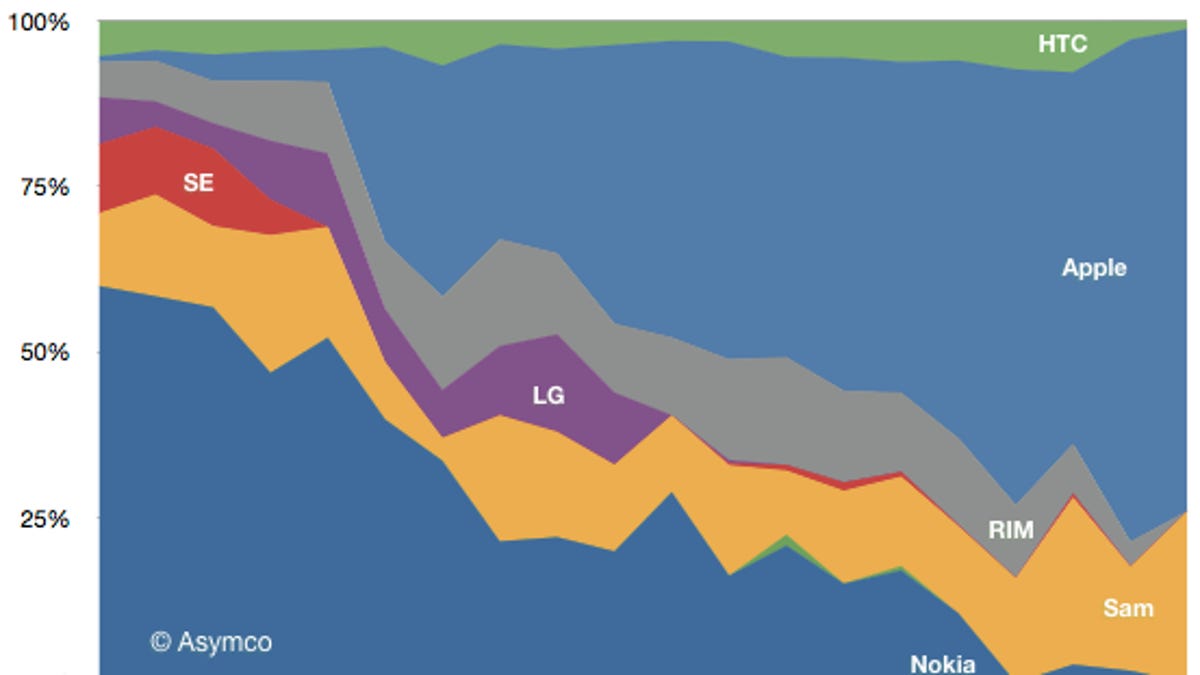

The iPhone maker has captured almost three-quarters of all profits, leaving Samsung with a quarter and little for anyone else, says Asymco analyst Horace Dediu.

Apple and Samsung essentially own the entire mobile phone market now, leaving nothing but scraps for the rest of the pack.

Tracking the industry's various players, Asymco analyst Horace Dediu found that Apple now holds 73 percent of all operating profits and Samsung 26 percent, leaving HTC with just 1 percent.

Some mobile phone makers, such as Motorola and Sony Ericsson, haven't seen a profit in years, according to Dediu, while LG has just about been breaking even since 2009. RIM and Nokia have been struggling to regain their former footholds, but both companies are being hit hard by the heavy competition.

Yet the industry itself remains strong. First-quarter profits soared to $14.4 billion from $5.4 billion just two years ago. Of course, most of that is being grabbed by Apple. But it's not so much that the iPhone maker has captured profits away from the other players but that Apple has created a new "pool of profits," according to Dediu.

And just what is that pool? Carrier subsidies for the iPhone 4S, says the analyst.

The carriers willingly cough up a premium to Apple to sell the iPhone for two reasons: 1) It provides a competitive advantage; and 2) it keeps their customers from jumping ship. That's why 250 carriers around the world now offer the iPhone, says Dediu (though 250 others still don't).

"Following this value proposition to its logical conclusion would suggest that the industry is rewarding those who can supply computers-as-phones which preserve the cash flows of what is essentially a trillion dollar data services business," according to Dediu. "Vendors which cannot offer this solution saw their businesses implode. At least on the high end."

Despite the increasing demand for smartphones, some industry players are still faring quite well by selling the good old-fashioned feature phone, many of them unbranded and unlicensed knock-off products.

Often costing $30 or less, these phones are considered "good enough" for a vast number of consumers, especially in underdeveloped countries.

These cheap knock-off phones are putting pressure on companies such as Nokia, which have been slow to jump onto the smartphone bandwagon but are no longer generating enough cash from their lower-end feature phones.

So we're left with a mobile market that Apple and Samsung have simply been able to gobble up.