AngelList attacks another startup pain point: Legal fees

Already the go-to place for tech startups looking for investors, AngelList is now helping startups with their legal docs. And that means a lot less work for lawyers.

AngelList -- a booming site where angel investors find tech startups to back -- is rolling out a product today that should please a lot of would-be Mark Zuckerbergs and, in theory, worry a lot of lawyers.

Ultimately, it could help both.

The site, founded in early 2010 by entrepreneurs/angel investors Naval Ravikant and Babak Nivi, is now offering standardized online documents that will make it faster and cheaper for any of the thousands of startups on AngelList to close their first round of funding.

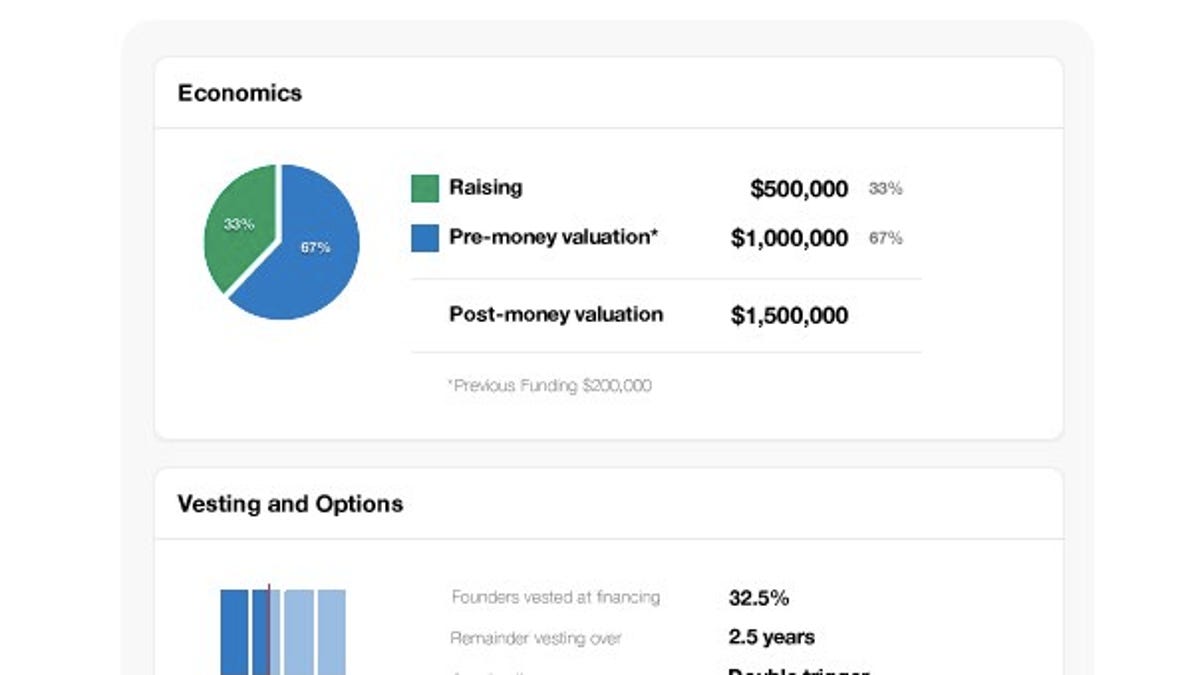

AngelList Docs, as it's called, breaks down the money-raising paperwork process in a clear, visual way that's designed, as the first doc says, to be "a term sheet for humans." A startup founder (with or without a lawyer) chooses a template for raising either standard equity or convertible debt. The tool guides you through the process and then generates all the needed documents, which in an offline world can amount to scores of pages after a lot of costly back and forth between lawyers for both the investor and the startup. It's a slog that Ravikant hopes to eliminate.

"We're doing all the docs, from soup to nuts," says CEO Ravikant, himself an early investor in Twitter and Foursquare, among others. "The only thing we don't do is we don't touch the money. A normal financing can now be done in about 30 days. We think it can be done in 3. And here's the key: attorneys don't hate it."

That last part was a surprise to Ravikant. While Silicon Valley law firms are racking up plenty of billable hours doing routine startup financing for the thousands of companies popping up, most of the work is just that: routine. It's not where the big legal fees are made. In fact, many lawyers do this work at a loss as a way to lure clients. The bigger law firms are hoping you are the next Facebook, or at least a growing company that they can bill monthly for all sorts of work.

In fact, AngelList is launching its Docs with one of the biggest startup law firms in tech -- Wilson Sonsini Goodrich & Rosati, which is waiving all fees for its clients who close seed investment rounds via AngelList Docs. (Despite the soup-to-nuts promise, startups are still going to need some lawyer help -- not just to make decisions, but to create what's known as a schedule of exceptions, which is particular to each company.)

A couple of years ago, startup legal guru Ted Wang, who's with Fenwick & West and has represented the likes of Facebook and Dropbox, launched SeriesSeed.com. He posts useful templates that have become popular for entrepreneurs raising money, but these get you only part of the way because they're static docs. Ravikant says Wilson Sonsini modified Wang's equity documents to create AngelList Docs.

"Hopefully, someday every company in Silicon Valley will close their financing online," says Ravikant. "They'll use the Interweb."

Ravikant is quick to point out that neither he nor anyone at AngelList is a lawyer. That's why AngelList teamed up with Wilson Sonsini and is now talking to several other firms about partnering. Ravikant did, however, influence a major law that President Obama signed in April and that opens up new business opportunities for AngelList. That was the JOBS Act, and Ravikant and his COO, Kevin Laws, worked tirelessly in Washington, D.C., to help get it passed and to make sure it included the McHenry Amendment, which lets companies provide financing docs without being an SEC-registered broker dealer. So long as AngelList doesn't negotiate the terms or handle the cash, it's now in the clear.

"This is one of the things we worked to get the JOBS Act passed for," says Laws.

On its own, offering online closing documents might not seem like that big a deal. But it's one more way AngelList is using software and the powerful community it's created to disrupt other industries. Remember where AngelList started: Ravikant launched the service in part to upend the traditional VC financing model by letting any startup get in front of private investors. Plenty of venture capitalists were scared and some certainly lost out on deals. But the smart ones got on board, and AngelList now counts powerful VCs such as Marc Andreessen among its 4,000 members. To date, more than 1,500 companies -- including hot startups such as Pinterest, Uber, and Branchout -- have met their backers on AngelList.

So what's next? In August, AngelList took a step to chip away at the recruiting business when it added a "talent portal" to help startups search for qualified tech talent. And already the site has led startups to meet with more than 10,000 candidates, according to Laws.

But the big one that AngelList is looking at is crowdfunding, which was also part of the JOBS Act and would, broadly speaking, let startups raise money directly through a site the way makers of products can raise funds through Kickstarter. The guidelines for how this will work are still being written by the SEC, however, but you can bet Ravikant and his team will be making sure their concerns are heard.