Google rises over profit, revenue estimates

The search and advertising giant fares better than analysts expected, and it announces a program to give employees more valuable stock options.

For the last quarter of 2008, Google followed the example of Apple and IBM, not Microsoft and Intel, reporting financial results above financial estimates amid a grim economic environment.

Google also announced a stock option exchange program intended to keep its employees happier.

For the quarter ended December 31, the company reported net income of $382 million, or $1.21 per share, a big decline from the $1.21 billion from the year earlier. Factoring out various costs, including stock-option expenses, though, the result was $5.10 per share, 15 cents above the $4.95 expected by analysts surveyed by Thomson Reuters.

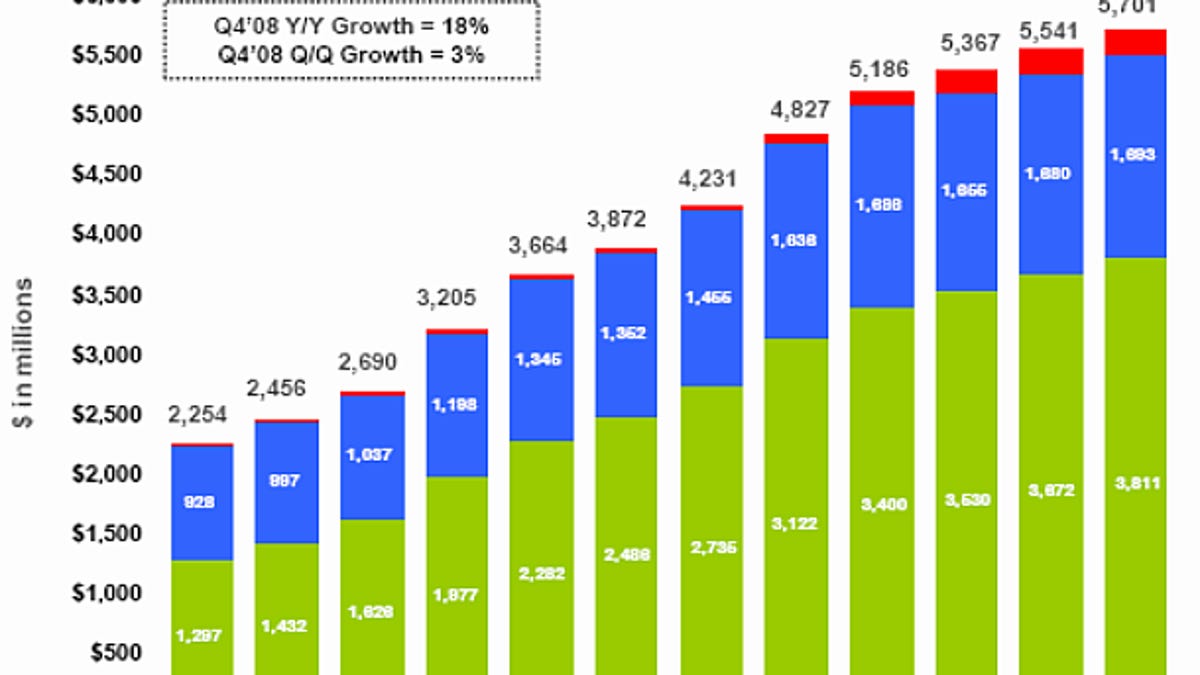

Total revenue was $5.7 billion, a 24 percent increase over the $4.83 billion from the year-earlier quarter. Excluding $1.48 billion in commissions paid to partners, called traffic acquisition costs, Google had $4.22 billion in revenue, ahead of analysts' projections of $4.12 billion and the year-earlier $3.39 billion.

"Google performed well in the fourth quarter, despite an increasingly difficult economic environment. Search query growth was strong, revenues were up in most verticals, and we successfully contained costs," Chief Executive Eric Schmidt said in a statement. "It's unclear how long the global downturn will last, but our focus remains on the long term, and we'll continue to invest in Google's core search and ads business as well as in strategic growth areas such as display, mobile, and enterprise."

Update 2:11 p.m. PST: In a conference call, Schmidt offered more caution than before about the economy, even as he said the company performed well in the fourth quarter.

"In some ways, the fourth quarter was the easy part," Schmidt said. Then, the economy was in "uncharted territory. Now it's clear we're in recession. We don't know how long this period will last. We're certainly prepared to get through this (with) no problem."

Schmidt also declared Google showed "tight controls over most costs, something that had eluded us, but we've got it down now."

Indeed, Google has cut contractors, laid off 100 recruiters, and closed many projects that didn't pass muster. Google is clearly undergoing an attitude adjustment while trying not to damage its attempt to foster innovation.

Google now has "more focused resource allocations going into 2009," said Jonathan Rosenberg, Google's senior vice president of product management. "The review process is now a part of how we do business."

Missing from the conference call were Google co-founders Larry Page and Sergey Brin, who might appear on future calls but for now will "continue to focus on technology," Schmidt said.

However, CFO Patrick Pichette wouldn't share any details about whether Google's cost containment is mostly done or only beginning. "We're just managing responsibly given the environment," he said.

Update 2:30 p.m. PST: Schmidt continued to bang the drum for search advertising, Google's main source of revenue.

"Advertisers invested where the ROI (return on investment) was highest--in other words, online," he said. "The quickest way to get revenue was targeted Google advertising."

Investors were inclined to agree with Schmidt's guarded optimism. Google stock was up $7.24, or 2 percent, to $313.74 in after-hours trading.

Google is more limited by the number of searches people perform than the number of advertisers vying through the AdWords auction process to have their ads shown, Rosenberg said. Google is paid when searchers click on search ads, and the cost per click (CPC) is a measurement of advertiser interest.

"Overall, the CPC is really driven by users and not quite as much the number of advertisers coming in and out over time," Rosenberg said. "If there were fewer transactions, it would adversely impact us. I don't think there's a CPC-based deflationary spiral because a modest number (of advertisers) went out of business. The auction is fairly robust. Many others would come into the auction if a transaction was going to be consummated."

And people kept searching and clicking those ads. The total number of paid clicks rose 18 percent compared to the year-earlier quarter, Pichette said.